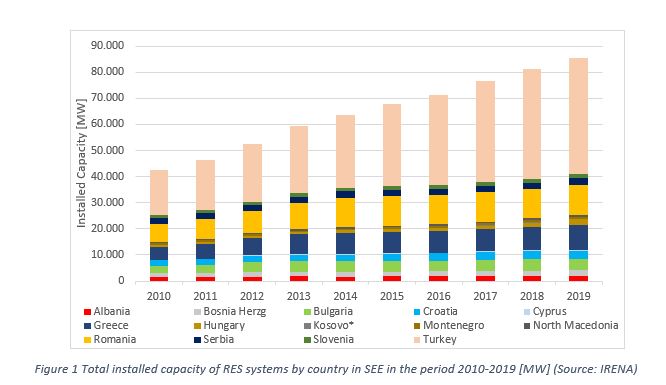

The installed capacity of Renewable Energy systems in SE Europe has more than doubled during the past decade, with local systems exceeding 85.56 GW of installed capacity in 2019 according to a latest IENE survey conducted as part of the Institute’s forthcoming “SEE Energy Outlook 2020/2021” report.

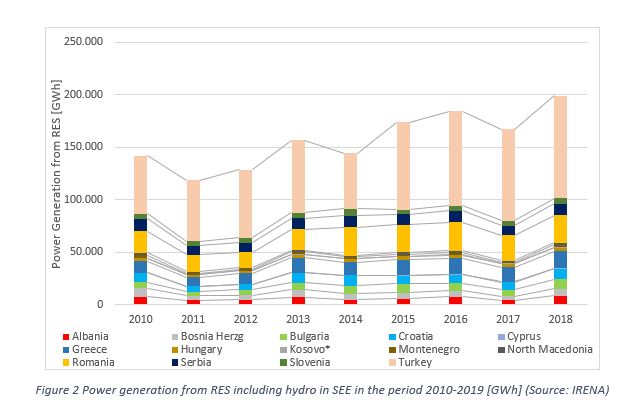

This represents an increase of 100.5% since 2010, when the region counted 42.68 GW of installed RES units. In addition, the power generation from RES including hydro has almost reached 200 TWh and stood at 199.2 TWh in 2018. This corresponds to a 40% increase over the last decade.

Electricity generation from RES in the SEE is heavily affected by the hydrologic cycle, which has shown signs of heavy volatility throughout the decade. Most notably the region was affected by drought especially during 2011, 2014 and 2017, when it halted the increase of y-y generation from RES, despite the increased deployment of other RES systems, mainly wind and solar. The most affected countries by the hydrologic cycle were Turkey, Croatia, Albania and Bosnia and Herzegovina.

The most widely deployed renewables are by far in Turkey, which has an RES fleet which consists mostly of hydro and wind, with a considerable capacity of geothermal energy, which in total exceeds 44.5 GW of installed capacity. Turkey is followed by Romania and Greece, with RES installed capacity of 11.2 GW and 9.8 GW respectively.

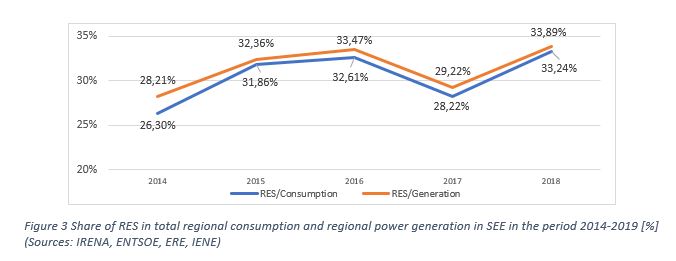

Moreover, RES units have increased their regional share in power generation to 33.89% in 2019, i.e. by more than 5.5% compared to 2014, when they contributed 28.2%. In addition, in 2019 the share of RES in total regional electricity consumption rose to 33.2% from 26.3% in 2014.

As RES have already been recognized as one of the most important resources in mitigating climate change, the global market is amidst an ongoing ramp up of RES installations, with production costs of variable renewables’ systems having fallen rapidly during the past decade. Consequently, lower costs have driven an escalation in the deployment of solar PV and wind turbines across the region, making them competitive. Recently, guaranteed feed in tariffs for RES systems have fallen below 60 €/MWh in regional markets (i.e. Greece), making them competitive, to lower cost thermal generation and thus more attractive to investors. The deployment of variable renewables is more evident in more mature markets such as Turkey and Greece, which of late have increased impressively their RES penetration, marking annual increases in their installed RES capacity by 5.6% and 8.7% in 2019 respectively.

* Kosovo is presented separately without prejudice to positions on status and in line with the United Nations Security Council Resolution 1244 (1999)