As reported in the March 2023 Energy Analysis Bulletin, prepared by IENE’s Research Unit, and send to members earlier this month Greece’s electricity and gas market is showing of late clear signs of differentiation

As reported in the March 2023 Energy Analysis Bulletin, prepared by IENE’s Research Unit, and send to members earlier this month Greece’s electricity and gas market is showing of late clear signs of differentiation.

More specifically, a clear trend in the domestic electricity market in March has emerged and covers the de-escalation of electricity prices, a downward move in electricity demand, a slow down in gas consumption and an increase in the contribution of RES to the power generation fuel mix. The highlights of the Greek energy market last month can be summarized as follows:

· A de-escalation of electricity prices was observed in Greece, as in March 2023 the average Market Clearing Price decreased for a third consecutive month, standing at €122.76/MWh, compared to €436.53/MWh last August.

· A downward trend is recorded in electricity demand in the last two months (February-March 2023). More specifically, energy demand decreased from 4 TWh in January 2023 to 3.9 TWh and 3.8 TWh in January and February 2023 respectively.

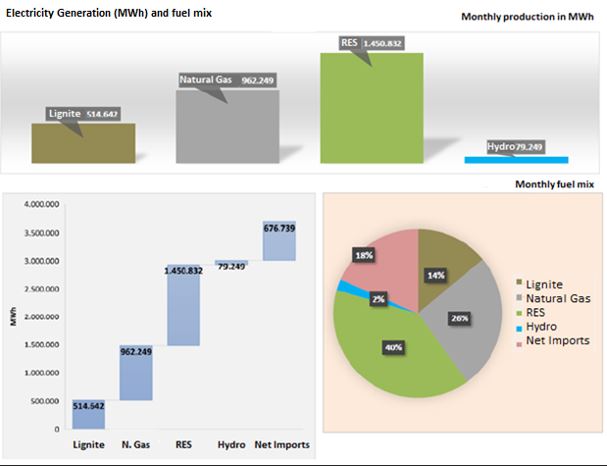

· On an annual basis (March 2022-March 2023), the share of RES in the fuel mix for electricity generation in Greece increased, by 6%, to 40% in March 2023, with the corresponding contribution of natural gas having decreased, by 21%, to 26%.

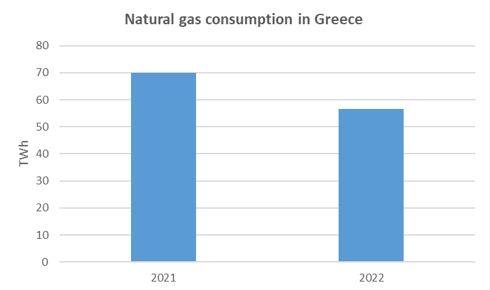

· In the first quarter of 2023, natural gas consumption decreased by 33.92% (y-o-y), while the total natural gas imports were down by 15.29% (y-o-y) in the first quarter.

Greece’s electricity generation and power generation fuel mix, March 2023

Greece’s electricity generation and power generation fuel mix, March 2023

In 2022, domestic natural gas consumption decreased by 19%, to 56.64 TWh, on an annual basis, mainly due to the industry’s shift to alternative fuels.

· LNG continues to dominate the country’s natural gas supply mix. More specifically, last March the market share of LNG in Greece’s total national gas imports was 68% and is considered as one of the highest percentages in recent years, highlighting the important role that this fuel now plays in a new gas market in the making.

· Natural gas exports were on the rise in the first quarter and reached 5.60 TWh exhibiting a huge increase of 120.05%. At the same time Russian gas imports decreased by 56.71%, and covered only 18.78% of gas imports in the first quarter as Greece continues its decoupling from Russian energy.

· The average gas price in the Dutch TTF last March ranged between €40 and €50/MWh, while on March 20 the price fell below €40/MWh for the first time since July 2021. Consequently, the weighted average import price of natural gas in Greece in March 2023 stood at €46.3/MWh, recording a third consecutive monthly decline.