As Turkey is preparing to hold its contentious referendum on April 16 and Greece’s radical left government is grappling with the harsh realities of the West’s capitalist system, unable as yet to come to terms with its lenders bail out conditions, the energy links between the two countries are quietly being forged as the so called Southern Energy Corridor takes shape. As it became known during a contracting parties meeting in Baku on February 28 first gas deliveries from the giant Shah Deniz II gas field in the Azeri sector of the Caspian will hit European markets in 2020. Gas will be shipped from the Baku hub via one of the world’s biggest ever pipelines spanning some 2,700 km from South Caucasus, through Georgia, Turkey, Greece and Albania and then underwater in the Adriatic, landing at St. Foca, in Puglia in South Italy.

Although the gas quantities to be delivered to European markets through the TANAP-TAP pipeline system, currently under construction, are not proportional to its giant size, and only amount to 10 Billion Cubic Meters (BCM’s) in the first phase and double that by 2025, its significance is considered to be huge as it will help diversify land delivered gas supplies to Russian import dependent EU. In spite of the fact that Azeri gas to be delivered first through TANAP, which crosses horizontally Turkey and then through TAP, which will tie up at the Greek-Turkish border and will end up in the Italian shores, will cover at best just 4.0% of European gas demand. However, European energy planners in Brussels and Washington appear ebullient since they claim that the South Corridor will punch a hole into what appears to be a tightly held Gazprom monopoly. But, given Europe’s growing dependence on Russian gas supplies- in 2016 Gazprom increased gas deliveries to European clients by 20 BCM bringing the total of is gas exports to 180 BCM’s which roughly corresponds to 34% of the continent’s gas demand- South Corridor’s impact is likely to be minor.

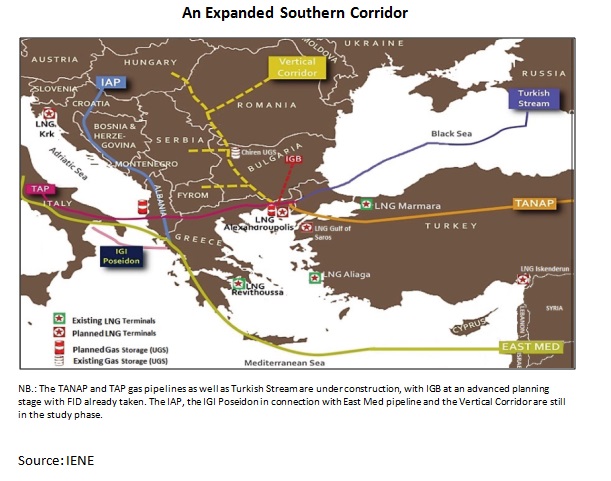

Far more important though for European gas supply will be an expanded version of the South Corridor which in addition to TANAP and TAP will include a number of major spurs such as the Vertical Corridor, with the Greek- Bulgarian interconnector (IGB) being the first leg of it, the IAP West Balkan Pipeline, the Krk LNG terminal in Croatia and the FSRU gas terminal in Alexandroupolis. Part of the enlarged South Corridor could also be the 1,700 km long East Med pipeline which promises to connect offshore gas fields in Israel and Cyprus to European markets via Greece. In between them these new gas infrastructure facilities will be able to deliver an additional 20 BCM’s to European markets. It is through the combination and diversity of the above new gas shipment routes and delivery points, which in essence constitute a vital East-West energy bridge, that the much touted gas supply diversification could be achieved. The geopolitical diversity being of paramount importance in view of the growing security concerns in Turkey and elsewhere along the Balkan route.

However, the imminent construction of the Russian

backed Turkish Stream pipeline through the Black Sea to first supply Turkey,

then the Balkans, and later on major European markets, in an effort to

circumvent Ukraine, comes to question the diversity element of South Corridor. To

add insult to injury, Gazprom, during last January ‘s European Gas Conference in

Vienna, publicly disclosed its high level contacts with TAP’s management to examine

the use of the pipeline to ship initial gas volumes from Turkish Stream to

Europe.

On the one hand Greece’s never ending financial instability and rather grim economic prospects and on the other growing concerns over Turkey’s security situation- which has already impacted energy infrastructure- and political uncertainty as President Erdogan solidifies his hold over the country’s institutions, is forcing energy planners to re-evaluate the region’s role as a vital East-West energy bridge. Although Greece and Turkey over the last ten years have strengthened their energy co-operation with a gas interconnector, an electricity cross border link and buoyant oil trade between them, latest political developments on both sides come to question their long term ability to lift the burden of a diversified European gas supply. Last but not least Gazprom’s stated plans to use the TANAP-TAP system to supply its European clients is negating the whole rationale behind South Corridor. In this context the promotion and actual development of an expanded version of the South Corridor (see map) is fast gaining ground as it will enable the inclusion of sizeable non-Russian gas volumes to be shipped through its extended network.

*Executive Director, Institute of Energy for SE Europe (IENE)

by Costis Stambolis*

by Costis Stambolis*

More

More