Europe has ended the winter season with record levels of natural gas in storage, putting the region in a much better position to move on from the energy crisis that has overshadowed it for more than two years

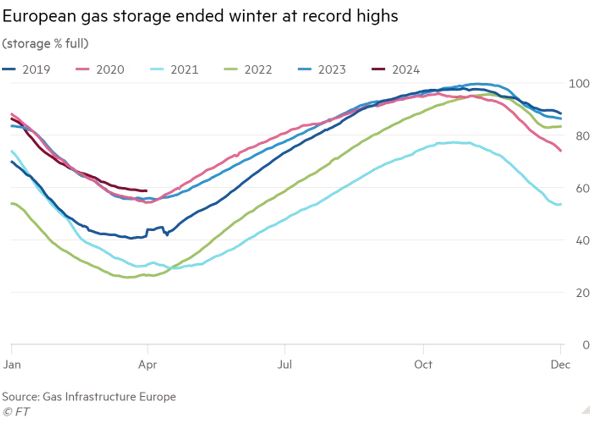

Europe has ended the winter season with record levels of natural gas in storage, putting the region in a much better position to move on from the energy crisis that has overshadowed it for more than two years. Gas storage for the EU at the end of March, considered the end of the winter season by the industry, stood at 58.72 per cent full, according to industry body Gas Infrastructure Europe. That is about 3 percentage points higher than the previous high, set last year. These figures include storage levels for most countries in SE Europe.

The plentiful levels put the EU in a comfortable starting spot as it refills its storages over the summer and analysts warn that the bloc may need to scale back imports of liquefied natural gas in the coming months to avoid capacity filling too early.

The generally mild winter across Europe, strong imports of LNG, lacklustre economic activity and the EU’s demand reduction targets helped keep gas usage in check. Demand was about a fifth lower in February than 2019-2021 averages, according to data from think-tank Bruegel.

That the EU finds itself in such a comfortable situation “is a surprise for everybody”, said Ana Maria Jaller-Makarewicz, lead energy analyst at the Institute for Energy Economics and Financial Analysis, a think-tank. “We thought [at the start of the energy crisis that] . . . we were going to have lots of problems,” she said. The EU’s decision to increase imports of LNG and introduce gas-saving measures were “very important” for the EU, she added.

Europe’s energy crisis began in 2021 as the region exited a prolonged cold winter with low natural gas storage levels. Concerns over tight supplies accelerated as Russia started to send less gas to Europe, in what was perceived by some as a tactic to pressure Germany and Brussels to approve the start-up of the controversial Nord Stream 2 gas pipeline.

The EU has now gone through two consecutive winters without significant disruptions to its energy system, something few believed possible at the start of the crisis, when blackouts were talked of as a real possibility. But “Europe has a problem of plenty this summer”, said Natasha Fielding, head of European gas pricing at Argus Media, a pricing agency.

The EU could achieve its target to reach 90 per cent capacity by the start of November in early August if the injection pace is similar to last year, she noted. “Europe may need to take less LNG this summer to balance out weaker demand and slow the pace of the stock build, thereby avoiding sites filling early.”

Last year European traders stored excess gas in Ukraine’s underground storage sites despite the war risks. Last week Russia attacked an underground storage site, although “the situation will not critically impact” operations, according to Naftogaz, the state energy company.

Despite the record volumes of gas in storages for this time of year, the price of TTF, Europe’s natural gas price benchmark, has risen around 20 per cent compared with a month ago when prices dropped to pre-energy crisis levels, as supplies tightened owing to maintenance at a major US export facility. Still, gas prices “can neither increase too much nor fall too much” from the current levels of around €25 per megawatt hour, said analysts at Engie in a note on Monday, thanks to the abundant gas in storage.