European electricity markets, including those in SE Europe have experienced an explosion in negative prices in 2023, according to a report prepared by ACER. Although the rapid expansion of renewable energy production played a part, other factors specific to 2023 might have influenced this increase in negative prices, the European Union Agency for the Cooperation of Energy Regulators (ACER) said

European electricity markets, including those in SE Europe have experienced an explosion in negative prices in 2023, according to a report prepared by ACER. Although the rapid expansion of renewable energy production played a part, other factors specific to 2023 might have influenced this increase in negative prices, the European Union Agency for the Cooperation of Energy Regulators (ACER) said. According to the 2024 Market Monitoring Report, 27 out of 50 bidding zones faced the highest amount of negative prices since 2017. Most Nordic bidding zones have seen the highest occurrence of negative prices – more than 380 cases.

Negative prices started occurring in Europe more than 15 years ago, largely as a result of an increasing share of renewable energy sources in production. Such events occur in the summer when solar power output is high, like this year in July, and in the winter with spikes at wind farms. The other important factor is the drop in consumption during holidays. Cases of negative prices call for continued market integration and access to flexibility, such as from demand response, ACER added. The agency has noted that barriers to the development of demand-side response have been compiled in a report published in December 2023. ACER said it is preparing reports on cross-zonal capacity for June and market integration for October to further investigate drivers for the surge in negative prices.

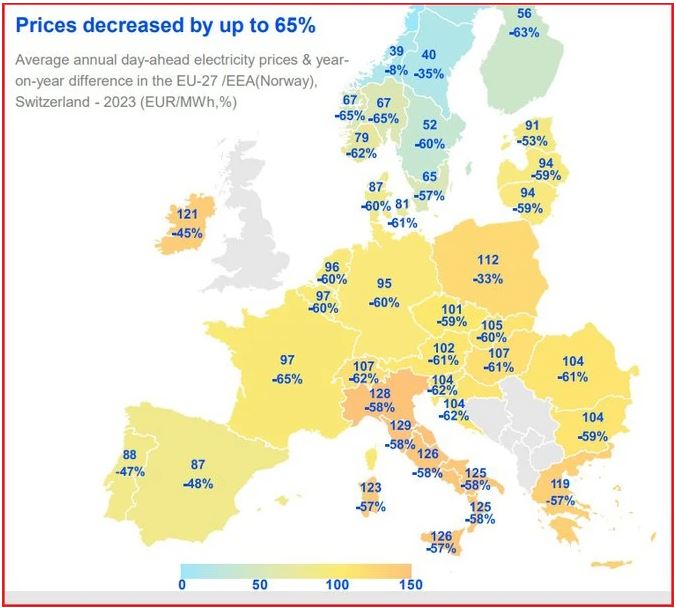

Its overview shows the key trends in electricity consumption and generation, electricity prices across timeframes, and for the first time it includes some key market parameters in the Energy Community. According to the report, energy prices stabilized last year after a volatile 2022 but day-ahead prices and variability remain higher than before the energy crisis. Lower gas prices, in turn, contributed to lowering day-ahead prices throughout 2023, complemented by a mild winter and energy-saving efforts. In 2023, the average day-ahead price was 93 EUR per MWh, less than half of the average 219 EUR per MWh from the year before, the document reads.

However, the average day-ahead price is still more than two times higher than in 2019 according to ACER. Similarly, the variability of prices is still higher than pre-crisis. ACER said that despite falling wholesale prices, energy remains costly due to supplier risk and market volatility. Energy suppliers continuously buy to meet future demand, facing potential losses in volatile markets, so the agency sees efficient risk-hedging solutions as crucial. Average prices in each member state decreased below EUR 130 per MWh last year, compared to between EUR 150 per MWh and EUR 300 per MWh from 2022. The level in 2021 was EUR 80 per MWh observed in 2021, according to the report.

The IENE follows closely developments In SEE Electricity Markets through the regular publication of It weekly "SEE Electricity and Gas Analysis", which is prepared by its inhouse team of analysts. A summing up of market movements is also reported in a concise way in a monthly basis.