After a 15-year absence from the international exploration scene, Greece made an impressive comeback with the introduction of a new legal and regulatory framework for hydrocarbon exploration and production in 2011, with the support of an enthusiastic government. In 2014 the government signed new concession agreements for three onshore and offshore areas in western Greece with a group of local and international companies, the first time since 1996.

After a 15-year absence from the international exploration scene, Greece made an impressive comeback with the introduction of a new legal and regulatory framework for hydrocarbon exploration and production in 2011, with the support of an enthusiastic government.

In 2014 the government signed new concession agreements for three onshore and offshore areas in western Greece with a group of local and international companies, the first time since 1996.

This was soon followed by an international round in 2015 and subsequent "Open Door” type of rounds, culminating in the signing of major offshore concessions with global oil leaders for three offshore areas in the Ionian Sea and in areas south and south-west of Crete.

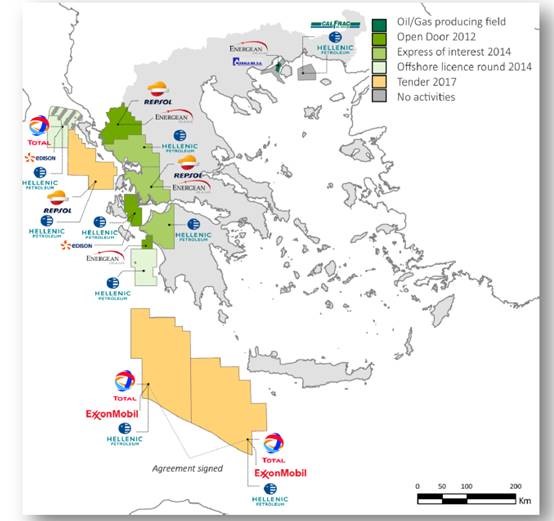

In all, Greece now has 13 live concessions (see map) which are the highest number than ever before. From these, only one, located at Prinos, in the North Aegean is oil-producing.

This field, which has been in constant operation since 1981, is still producing limited amounts of crude oil, while in its 40-year history it has delivered some 120 million barrels of oil, double the original estimate when the field was discovered in the early 1970s.

This is a stat which clearly shows the longevity and capacity that hydrocarbon deposits in Greece could have.

Energean, which is the operator of Prinos, and has carried out extensive seismic and exploration work in the area, is now getting ready to ramp up production to 5,000 to 6,000 barrels per day following latest discoveries of new deposits with proven reserves exceeding 40 million barrels.

Energean will also proceed later this year with a production drilling in its offshore Katakolon concession, in NW Peloponissos, which means that production of some 2,000 to 3,000 barrels will come on stream next year.

Elsewhere in western Greece, Hellenic Petroleum is supposed to be getting ready to proceed with its first major exploratory drilling operation offshore in the Patraikos Gulf, where the discovered field could be holding some 100 million barrels of oil in place.

Currently, very promising seismic work is being carried out by Spanish oil firm Repsol (operator) and Energean in a number of onshore areas in the Ioannina district with plans for actual exploratory drillings next year.

At the same time, Total and ExxonMobil are planning seismic work in their offshore concession areas south of Peloponnesus and Crete, but with no immediate plans for exploratory drillings.

Exploration doubts

However, following the abrupt dismissal last January within the space of 30 days of three senior officers from Hellenic Hydrocarbon Resources Management (HHRM) and from Hellenic Petroleum’s upstream division, Greece’s plans to pursue further hydrocarbon exploration have been cast into doubt.

Energy analysts in Athens are pointing out that the almost simultaneous removal from the hydrocarbon scene of Greece’s three leading officials sends a rather negative message to international companies, now engaged in oil and gas exploration activities in both onshore and offshore areas.

Over the last five years ExxonMobil, Total, Repsol, Energean and Hellenic Petroleum (HELPE) have signed concession agreements with the Greek state and are committed to spending billions of dollars in exploration and production work.

These companies have between them signed some 12 concession agreements, for blocks in western Greece, the Ionian, south of Peloponissos and south-west of Crete.

Plans by HELPE to carry out a first offshore exploration drilling in the Patraikos Gulf later in the year have now been put on hold.

Furthermore, there appears to be an internal struggle brewing within the government following the signing earlier this year of a major trilateral agreement (between Greece, Cyprus and Israel) to promote the huge EastMed gas pipeline project.

This is a very demanding project, by international standards, of the mostly underwater pipeline which will cost some €8.0 bln and is destined to bring substantial gas volumes from East Mediterranean fields, through Greece, to the main European gas markets.

This pipeline will also provide Greece with a gateway for its own gas from the yet-to-be-discovered gas fields south of Crete.

Independent energy analysts in Athens observe that pursuing this major project now comes in direct conflict with the Greek government’s latest change of policy priorities to downgrade its interests in hydrocarbon search and possibly proceed in nullifying all concession agreements with international companies.

The ample support which the present Greek government has provided wholeheartedly, from day one to all kinds of environmental pressure groups bodes well with its latest move to back away from hydrocarbon exploration, note these analysts.

Stranded assets

Sources close to the government’s senior echelons have revealed to the Financial Mirror, that since the government of PM Kyriakos Mitsotakis decided to embrace the European Commission’s New Green Deal, its priorities no longer include the development of the country’s substantial oil and gas resources, which some members of the cabinet have rushed to describe as "stranded assets”.

Consequently, the government is now faced with the option of further increasing gas and electricity imports since at the same time it is committed, following pressure from Brussels, to fully decarbonise its energy system by 2028.

This means that over the next few years the country’s major electricity company PPC/DEH will have to shut down some 14 lignite-fired power plants corresponding to 4.0 GW of installed capacity.

Hence, Greece’s energy dependency, which now stands at 75% and is one of the highest in the EU, will very soon jump to 85% and possibly higher, pending the large-scale development of its significant renewable energy potential.

According to the government’s latest "Energy and Climate Action Plan” submitted to the EC at the end of 2019, renewables should be able to cover 35% of the country’s final energy consumption by 2030 and more than 60% in the electricity mix, with the rest of the required energy to be imported.

Even then, according to independent analysts, it is highly doubtful that such an ambitious goal can be achieved as the currently pursued energy policy, with the total lack of inputs from indigenous energy sources such as gas and coal, which can provide the necessary electricity baseload, is leading to an impasse with dire consequences for the country’s deteriorating balance of payment situation.

Unlike the Republic of Cyprus, the Greek government is not much concerned with the anticipated substantial financial flows which could result from the consistent development of the country’s not insignificant hydrocarbon resources.

It seems that the Mitsotakis government is placing all its bets on its "green” agenda which prioritises the exploitation of large-scale Renewable Energy Sources against all other types of fuel.

And although sun and wind are free, the equipment required to tap them is not and almost all of it is being imported at a huge cost.

Financial Mirror, Cyprus, 16 03 2020