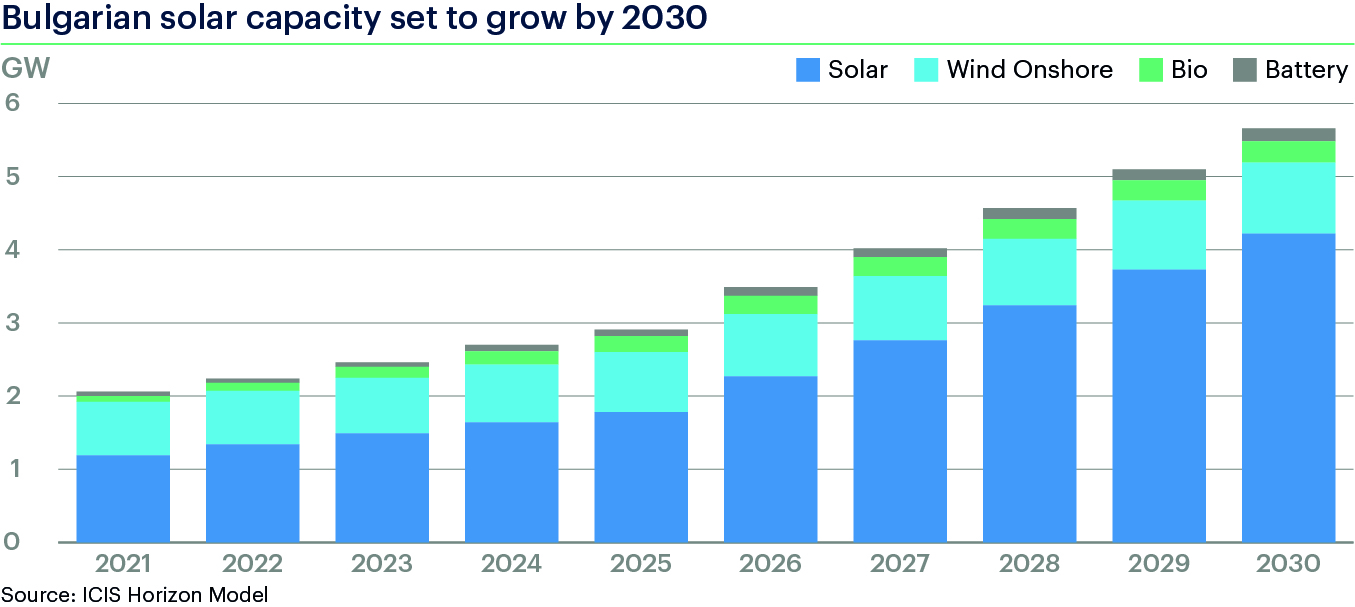

Bulgaria needs to ramp up its renewables capacity to achieve its ambitious plans to develop 1.1GW green hydrogen production capacity by 2030, several market participants told ICIS.

The country plans to produce hydrogen by electrolysis using renewable sources and sets a goal of installing additional 800MW wind and 280MW solar capacity by 2030. At the moment Bulgaria has around 1GW solar and 700MW wind capacity in operation.

The above goal is separate to the National Energy and Climate Plan (NECP) which targets 2.1GW solar, 250MW wind and 250MW biomass capacity for the same period. Power consumption for hydrogen production through “Power to X” is set to be 47GWh in 2030, said the NECP.

However, the renewable capacity targets seem insufficient for the purpose of producing green hydrogen.

“To achieve the target share of renewables in gross final electricity consumption by 2030 we would need roughly about 2,000MW of new wind and solar capacities, and to produce only green hydrogen - an additional about 9,000MW,” said Velizar Kiriakov, chairman of Bulgaria’s Association of Producers of Ecological Energy (APEE).

“If we decide to direct all the electricity produced from renewable sources, which for 2020 is 6,813GWh (water, wind, solar and biomass) to produce hydrogen, then the said energy will be removed from the energy mix, therefore the targets for renewables will not be met. This means that with the existing capacities to-date we could not produce green hydrogen. We need newly installed capacities,” Kiriakov added.

Bulgaria’s renewable energy production between 1 January - 21 March this year fell by almost 12% year on year to 699.5GWh, data from the grid operator ESO showed.

The APEE chairman stressed that the best strategy for hydrogen production is to have it close to the point of consumption to save costs for the construction and use of pipelines, as well as the transport losses.

Kiriakov proposed that a large industrial gas consumer could take the following steps towards hydrogen use:

• change its fuel installations to utilise and operate on hydrogen,

• build a photovoltaic or wind farm near the industrial site, the energy from which will be used to produce hydrogen.

“We do not think that in the next three years it is realistic to expect active green hydrogen projects in Bulgaria - both for production and use. However, the steps that are being taken in this direction are important,” added Kiriakov.

“I do not think that Bulgaria has a hydrogen strategy yet. Many companies have expressed interest in hydrogen amid the availability of significant EU funding. Maybe in a few months a clearer view will emerge. Otherwise, there is potential,” said a local gas analyst.

IMPACT ON GAS

Separately, Bulgarian state-owned grid operator Bulgartransgaz is planning to expand its existing gas network to transport hydrogen, the company said in its updated 10-year development plan.

“According to rough calculations, for the complete replacement of the natural gas currently used in the Bulgarian industry, we need about 400,000 tons of hydrogen per year, so we need to produce about 18,500GWh of electricity,” added Kiriakov.

Bulgaria’s annual gas consumption is expected to rise from 33TWh in 2021 to 44TWh in 2030, according to Bulgartransgaz, driven mainly by growing industrial demand and rapid gasification across the country.

“Existing natural gas transmission infrastructure could play a significant role in the transition to a low-carbon and circular economy,” said Teodora Georgieva, chief executive officer and executive director at project company ICGB.

“The arguments in this direction are related to the minimum capital costs for achieving the operational possibility for transmission of a mixture of natural gas and hydrogen or other biogas through the already existing gas transmission systems, compared to investing in new infrastructure, “ added Georgieva.

However, the current Bulgarian gas infrastructure is not designed to flow hydrogen, according to source from a leading local gas firm.

The Bulgarian government plans to apply for €333m funding from the EU Recovery and Resilience Facility Fund for 2021-2025.

“This is a chance for Bulgaria to effectively use EU funds to restructure the most affected sectors of its economy such as mining, heat and electricity production from coal and others, and to bet on the development of innovative, environmentally friendly technologies for hydrogen production and its wider use,” said Georgieva.

(ICIS, March 29, 2021)