The accelerated growth of electricity prices on the OPCOM electricity exchange in January2017 continues to be a controversy fueled by emotions, manipulation and incomplete understanding. Without a doubt, there are persons to be held accountable, important lessons to be learned, and things to be corrected, but this begs for a serious and objective analysis.

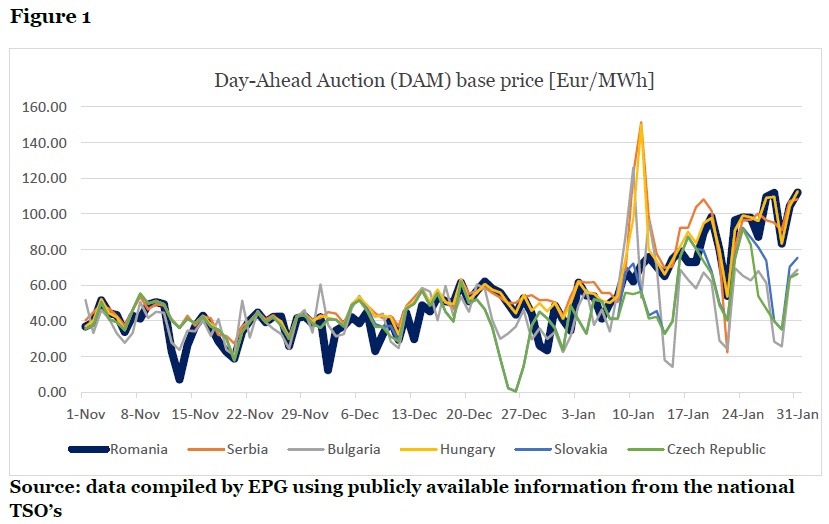

Let’s notice from the very beginning (Figure 1) that January – especially the second part of the month – was a very volatile period for all the regional power markets. The day-to-day variability was highest on the Hungarian and Czech markets. Further, it can be noticed that on the coupled 4M MC market, there was a stronger price coupling between the Romanian and Hungarian Day-Ahead Markets (DAM), respectively between the Czech and Slovak ones.

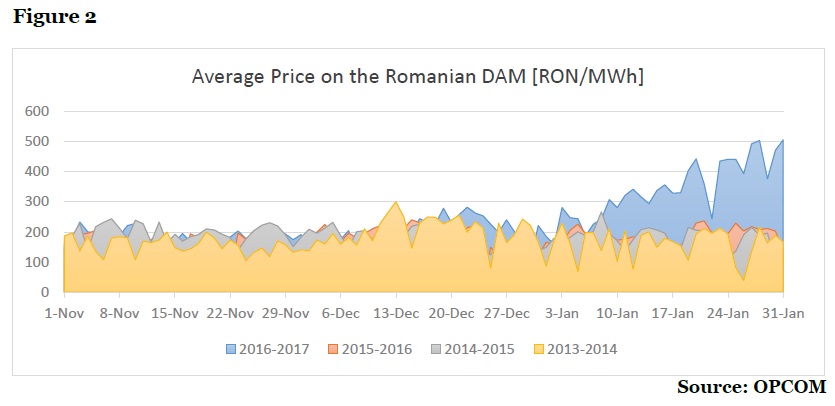

Nevertheless, the average price in Romania was one of the highest – after Hungary and Serbia – and considerably above the average of previous years. Indeed, a DAM base price comparison for the November - January timeframe from 2013 to 2017 shows a significant deviation from the norm in January 2017.

Two immediate questions arise: was the price increase linked to increasing volumes traded or to increasing consumption? And were there any other specific elements that influenced the market this January, in particular?

By way of illustration, the difficulties experienced by the natural gas market in 2014, when the transit through Ukraine was disrupted, had a direct effect on the supply of gas in Eastern Europe – especially in Bulgaria. Notwithstanding, there was no effect on the electricity price even though gas-fired power plants reduced their production to the minimum, so as to ensure the reliable supply of natural gas for household consumption and heating.

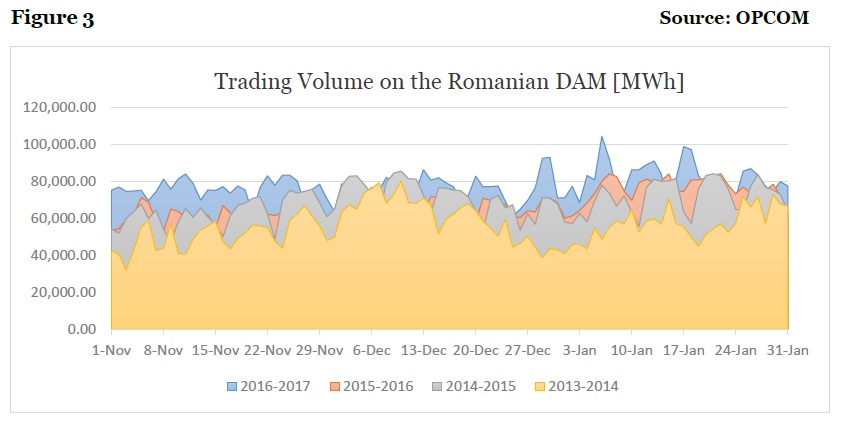

A comparison of the quantities traded on DAM in the winter months of the last four yearsshows that DAM supply tends to have a relatively stable pattern (Figure 3), with no longtermeffects caused by the occasional demand increases. Even though the volumes tradedduring the winter of 2016-2017 are relatively higher than in previous years, this trend is heldfor the entire reference period, not just for January 2017.

For the 2013-2015 winters, a correlation can be observed between the DAM-traded volumesand the average base price, correlation that was not found in January 2017. In other words,although the market conditions are relatively the same, the prices went up significantly.

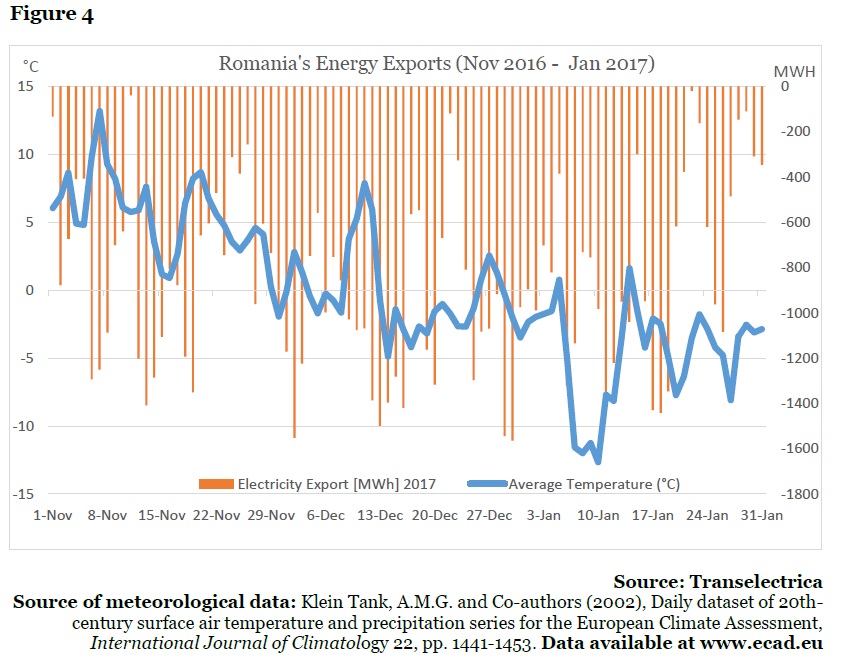

Thus, the question is whether we had, in January, a deficit of energy primary power sources leading to the lack of capacity to produce electric power to meet demand. In effect, in this period Romania ensured its domestic consumption from domestic sources. What is more, in January 2017, Romania exported on average about 780 MWh.

It is interesting to compare the evolution of exports with the evolution of average temperatures in the country between November 2016 and January 2017 (Figure 4). As it can be seen, power exports do not drop when the temperature levels are extreme, as one would have expected if Romania could not ensure its internal electricity demand. Moreover, the concerns generated by allegations that the domestic coal and natural gas stocks were insufficient, the low level of water in reservoirs or the functioning at reduced power of the nuclear reactors due to a low flow of the Danube, should have been reflected in production cuts so as to ensure the conservation and long term availability of resources. However, the Romanian power generation was influenced by the willingness of the regional markets to buy power, reflected in the peak prices on these markets, which made the Romanian power production competitive for exports.

Another element that must be taken into consideration is the price evolution for natural gas used for heat and power generation. Natural gas is a product sensitive to energy security concerns, especially in Central and Eastern Europe, because of the single major supply source and the perception that gas price is, sometimes, dependent on the evolution of the international political context.

Until the fall of 2016, Romania did not have a transparent reference-base for natural gas prices, as natural gas transactions were mostly bilateral and confidential. Starting in fall 2016, the Cioloș Government forced the natural gas producers and suppliers to trade minimum quantities on centralized platforms, in order to increase transparency.

The data available at this moment is insufficient for an illuminating comparison. It has to be kept in mind that the price of imported gas was, at the beginning of the year 2017, at the record low of the last few years – albeit with a subsequent growth tendency, due to the increasing international price of oil since November 2016 – which led to a steep increase in imports this winter, thereby increasing energy supply security, which in turn should have prevented major price deviations.

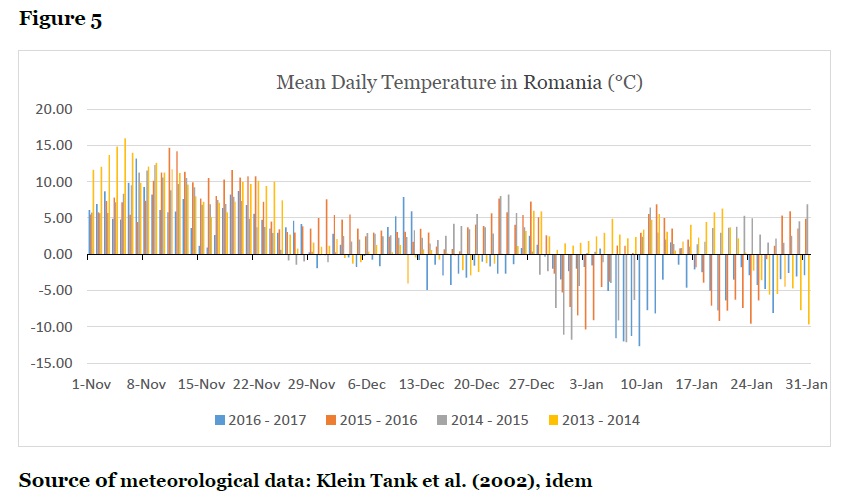

Looking beyond the price of raw resources and the availability of production sources, it isuseful to analyze the weather pattern of the last few years. The temperature chart shows thatevery year brought roughly one week of very low temperatures, but this was not reflected insignificant price deviations and a long-term impact on electricity production. Nonetheless,the winter of 2017 began in December 2016 with average temperatures below freezing point.However, this was an opportunity for the Romanian producers, not an obstacle.

The nation-wide average daily temperatures below freezing point for an extended period canrepresent an element of pressure on the price of electrical energy, on one hand objectively,through the unavailability of some production sources, and on the other hand subjectively,because of fear of an imminent crisis instilled in the market by the alleged inability of theenergy system to deal with the situation. Regarding the unavailability of some powergeneration units, Transelectrica’s reports shows that the Romanian production unitsoperated at full capacity, except for some short-term local breakdowns.

The shape of energy exports (Figure 4) clearly shows that the cold period represented a commercial opportunity for the Romanian producers and that the introduction of restrictive measures regarding exports would have been a major error, with serious negative effects on the profitability of Romanian energy companies.

Given that the analysis reveals that there were no objective reasons for the acceleratedgrowth of electricity prices on DAM in January 2017, can one talk about a speculative attackon the electricity price in Romania, such as those experienced by the national currency in2008, for example? Such a hypothesis is difficult to confirm with the data publicly availableat the moment. Both ANRE and the Romanian Competition Council have announced aninvestigation regarding these speculative transactions.

Market sources also mention the intervention of European institutions, apparently inconnection with several transactions with cross-border impact. At the same time, Enel, oneof the main energy distributors in Romania announced that two other distributors havedenounced long term supply contracts, in order to take advantage of the escalating prices onDAM. One certain conclusion that can be drawn is that the electricity market regulator has tomake use of mechanisms to deter the parties’ infringement of contractual obligations, so asto prevent and limit the possible spillover effects on the short-term market.

Moreover, important energy traders like Trasnenergo and Arelco, filed for insolvency. Thecauses of these insolvencies are not yet clear, but the Judicial Receiver’s report will clarifythis until mid-2017.

The volatility of the Romanian electricity market must allow drawing a fundamental lessonabout the market’s dysfunctional and vulnerable aspects. A thorough and complete analysiswill have to be done at all market levels: transactions, contracts, governance, regulation,hedging, rules of conduct, transparency.

Given that Romania is quickly moving towards the completion of a centralized natural gastrading market – including through the elimination, from April 2017, of the predeterminedprice for the internal production of natural gas – it is necessary to make use of the currentmechanisms and specific regulations, and to introduce new ones, to limit the effects of possible massive price volatility caused by speculative behavior. This is an obligation towardsall market participants and, first and foremost, to end consumers.

(Energy Policy Group, www.enpg.ro)

by Victor Grigorescu, Radu Dudău, Lucian Indrieș

by Victor Grigorescu, Radu Dudău, Lucian Indrieș

More

More