Although we need a "balanced point of view” on the global energy market, it is not sure that we are heading towards a balanced situation, Prof. Tatiana Mitrova stressed at IENE’s 9th SE Europe Energy Dialogue, which took place in Thessaloniki on June 29-30, 2016.

The Research Scholar of the Center on Global Energy Policy, Columbia Global Centres (France) and Head of Oil and Gas Department, Energy Research Institute of the Russian Academy of Sciences (Moscow) noted that our recent experience from the oil market shows that the balance depends on non-economic factors that are hard to define. One very noticeable example is the tactics by Saudi Arabia in oil production, which, just some years ago, would be considered out of the question.

According to Prof. Mitrova stressed that the current low oil prices jeopardize future investments. Only in 2016 investments of 400 bn. dollars were postponed, leading to shortcuts in production in 7 to 8 years, to the harm of consumers.

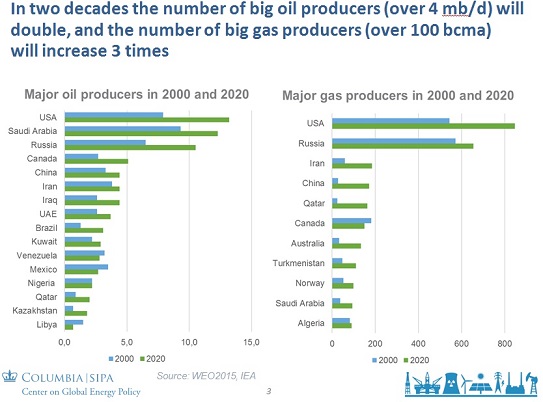

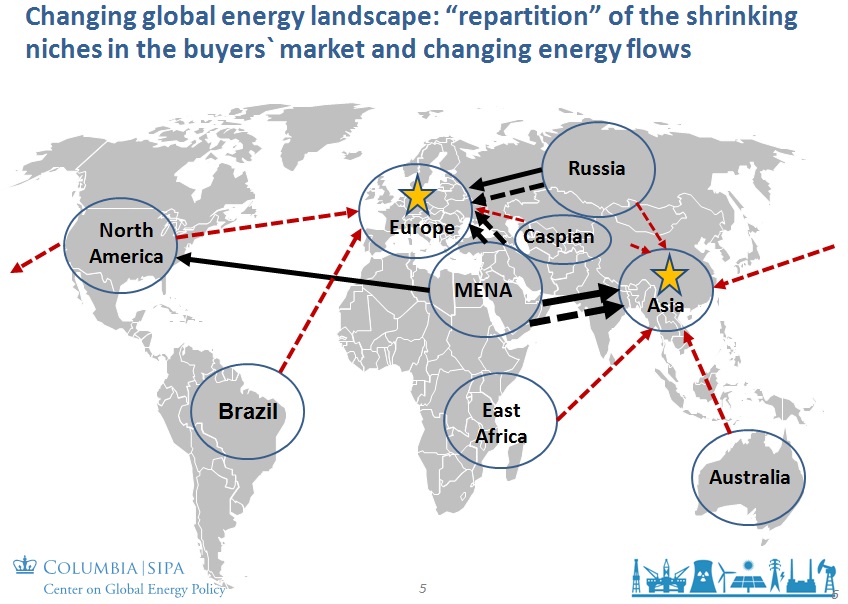

Prof. Mitrova estimated that, from 2000 to 2020, the number of major oil producers is set to double and, in the case of natural gas, to triple. However, two geographic areas remain, basically, the major consumers: SE Asia and Europe, whereas N. America is "closed”, relying mainly on its indigenous production, thanks to the "shale revolution”.

As she noted, customers can

now get better terms and prices. Furthermore, Prof. Mitrova predicted that the current

"bubble”, stemming from low oil prices, will last 2 to 3 years, while, in gas,

the rise of LNG share by 50%, it will last 5 to 6 years. She added that the Energy

Union is good, but market forces should be left to work on their own.

Finally, she referred to the changes underway in the pricing methods and to the

rise of the spot markets. However, Prof.

Mitrova characterized SE Europe "a special case”, as it lacks an energy

exchange, noticing, moreover, that gas hubs are not imposed by governments but

are being formed by the companies.

Although we need a “balanced point of view” on the global energy market, it is not sure that we are heading towards a balanced situation, Prof. Tatiana Mitrova stressed at IENE’s 9th SE Europe Energy Dialogue, which took place in Thessaloniki on June 29-30, 2016

Although we need a “balanced point of view” on the global energy market, it is not sure that we are heading towards a balanced situation, Prof. Tatiana Mitrova stressed at IENE’s 9th SE Europe Energy Dialogue, which took place in Thessaloniki on June 29-30, 2016

More

More