by Costis Stambolis* The question is not rhetoric and alludes to the fact that 10 years after the discovery of the gigantic Leviathan field offshore in Israel and 6 years after the finding of the smaller, but significant nevertheless, Aphrodite reservoir within Cyprus’ EEZ, not a single cubic feet of gas has been exported nor is it likely any time soon

The question is not rhetoric and alludes to the fact that 10 years after the discovery of the gigantic Leviathan field offshore in Israel and 6 years after the finding of the smaller, but significant nevertheless, Aphrodite reservoir within Cyprus’ EEZ, not a single cubic feet of gas has been exported nor is it likely any time soon. And this is not because of the limited size of the reservoirs discovered so far or lack of interest on the part of investors or the difficult seabed terrain but rather because of the highly complex, and often conflicting, circumstances which currently exist and make it difficult for the laying out of adequate long term plans for the exploitation of the extensive hydrocarbon potential of the region.

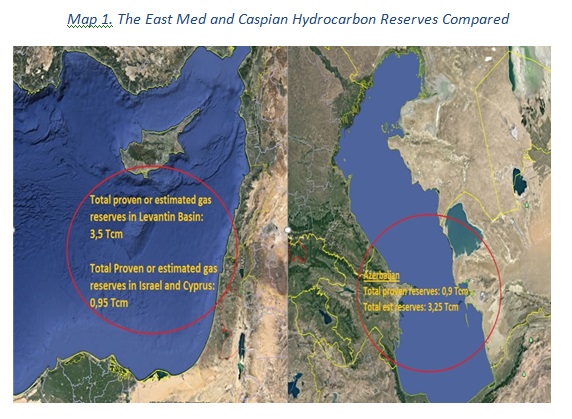

To start with this vast potential cannot be easily disputed since following the first gas discoveries offshore in Israel, starting with Noa, and Mari-B in 2007 we had significant findings almost every year since then. Just to remind our readers we had Tamar and Dalit in 2008, and Leviathan in the same year followed by Dolphin (2009), Aphrodite (2010), Tanin and Karin (2011) and the huge Zohr field in Egypt in 2015, which lies within the same geological basin. The region’s proven reserves, amount to almost 3.0 trillion cubic meters of gas and 10 tcm of both proven and contingent. In the Leviathan basin alone (read Israel- Cyprus- Lebanon) proven reserves today amount to 0.75 tcm and together with contingent stand at 3.75 tcm, which is on par with the much touted Caspian gas reserves; which USA and EU energy boffins are pushing hard for energy security reasons in order, as they say, to help diversify EU’s gas supply and lessen Russia’s grip on European energy demand (see Map).

The bottom line of the above exposé is that East Med gas reserves are more than enough to amply satisfy local needs in Israel, Cyprus and Lebanon combined and hence the question arises as what to do with the excess gas that can be produced. In view of the fact that the major gas consumption centres are way off East Med’s waters one has to think of various export options which involve hundreds if not thousands of kilometers of underwater pipeline networks or the construction of capital demanding liquefaction plants, which produce LNG, which could then be loaded for export worldwide, and not just to Europe. However, the economics of building lengthy pipelines and/or LNG plants are complex to say the least and most of all they require actual customers at the other end who will be willing to commit themselves through long term contracts to purchase sizeable gas quantities. Such types of contracts, normally oil indexed, require clear cut demand needs from the purchasers side which will need to be satisfied by the gas to be shipped from the production centre, the East Med complex in our case.

There lies the problem since the world and Europe more specifically are currently facing an oil glut situation with global energy markets undergoing a period of low gas prices. As far as Europe is concerned, which because of its proximity appears to be the most promising destination for East Med gas exports, gas demand over the last years is stagnant, down 20% from a peak 10 years ago. The key reasons being cheap coal and subsided renewables with no prospect any of these factors being reversed any time soon. Meanwhile as indigenous European gas production drops every year (as North Sea reservoirs decline) Russian gas imports take their place mainly due to access and availability and their low price ($4/mm BTU). It is quite indicative and became known only two weeks ago, when Gazprom’s Deputy Chairman Alexander Medvedev spoke at the annual European Gas Conference 2017 in Vienna, that Russian gas exports to EU-28 reached an all time peak of 180 bcm in 2016 (covering almost 40% of European gas demand), up by 20 bcm compared to the previous year. With the Nord Stream II Russian owned pipeline in the Baltic soon to be build and the Gazprom backed Turkish Stream pipeline, construction of which underwater in the Black Sea is scheduled to start later this year, Russia will strengthen enormously its gas export regime to Europe. And it is against this reality that East Med gas will have to compete.

In spite of European gas demand decrease over the last few years, eventually as latest analysis by the IEA in Paris and by BP in its latest Global Energy Outlook suggest, European energy demand is set to recover over the next years (but at a slower pace). At the same time as indigenous oil and gas production is reaching it's limits, and already declining, there will be a need for gas increased imports and therefore export opportunities for East Med gas can be identified. Today EU 28 is more than 53 per cent energy import dependent, with this figure set to increase as in addition to oil and gas there is going to be a further decrease in locally produced coal and lignite in view of stringent environmental considerations.

In view of the above Europe will remain a very promising gas export option for East Med gas but negotiations with interested parties will need to be speeded up in order to secure firm contracts of actual quantities to be shipped. However, a number of other quite pragmatic options also exist such as by means of pipeline to Egypt, for partly meeting fast rising local demand or for export via LNG from the currently idle liquefaction plants at Idku and Damietta. An export route to Turkey is also on the table as Ankara is trying to diversify its gas import in view of rising demand (45 bcm consumption annually) and the need to strengthen its energy security. To this end Israel has embarked on lengthy negotiations with Turkey’s BOTAS in order to determine prices and technical specifications. One more option is the construction of the East Med pipeline to Greece and from there to Italy, promoted by Greece’s DEPA and Italy’s Edison. A latest economic feasibility study has revealed a cost competitive CAPEX of €5.0 billion for 10-12 bcm/year export volume.

Unable to wait any longer Israel’s Delek, Leviathan’s operator, has secured 10.0 bcm/year gas sales to Israeli industrial customers and to a Jordanian potash plant from the first phase of Leviathan, while actively exploring the Turkey option for the 2nd phase of Leviathan’s development. But even with Turkey Leviathan I and II will still be left with more gas to export. Between them Leviathan and Aphrodite have a capacity to export as much as 30-40 bcm/year, says Charles Ellinas, a well known gas expert and former head of Cyprus National Hydrocarbons Company. For Cyprus, which so far has only Aprhrodite’s limited reserves to consider, the export option is more difficult and hence, as many industry executives argue lately priority should be given to using its gas for local use and to building up its domestic gas market. The same executives say in no uncertain terms that if an export strategy is not soon in place East Med gas, and Cyprus gas particular, will run the risk of remaining stranded for many years.

*Costis Stambolis is Deputy Chairman and its Executive Director of IENE